Table of Content

This would be especially apparent if the veteran could retain the home through a modification to the interest rate and, for example, a principal reduction from the infusion of HAF funds. Clearly, these funding fees can add thousands of dollars to your loan costs. If you pay the fee at loan closing, you need to come up with additional cash to close.

In recommending that VA align the COVID-VAPCP with other federal partial claim programs, commenters focused on three specific program features. If you’re using a VA home loan to buy, build, improve, or repair a home or to refinance a mortgage, you’ll need to pay the VA funding fee unless you meet certain requirements. If, after applying for a refund, the VA approves your request, you will receive the refund in one of two ways, depending on how you initially paid the funding fee. If you paid the fee in cash at closing, you will receive a cash refund for the amount of the funding fee. Through the end of the nationally declared emergency, you can make an initial request for COVID-19 forbearance.

Other Assistance for Delinquent Veteran Borrowers

The cost of rule familiarization is $99.90 for each guaranteed loan servicer, including the small servicers. The PRA cost estimates vary across servicers depending on how many COVID-19 forbearance loans they service that either meet or could potentially meet COVID-VAPCP requirements. An internal assessment indicates that approximately half of VA-guaranteed loans in forbearance will reach 360 days of forbearance sometime during the months of May and June of 2021. However, as discussed above, VA has been a part of the coordinated federal response that extends protections for borrowers with federally backed mortgages. Given these additional protections, VA now anticipates that most veterans currently in a COVID-19 forbearance will remain in such forbearance until at least late June 2021.

The guaranty amount is what VA could pay a lender should the loan go to foreclosure. You receive disability compensation from the VA for a service-connected disability. Servicers must continue to service the guaranteed loan in accordance with subpart B of this part. A veteran may make payments for the subordinate loan, in whole or in part, without charge or penalty. If the veteran makes a partial prepayment, there will be no changes in the due date unless VA agrees in writing to those changes.

PART 36—LOAN GUARANTY

As evident from this final rule notice, public input was valuable to ensuring that VA implements a partial claim payment program that delivers on its commitment. VA is now faced with determining whether it should accelerate the effective date of this program beyond statutory timeframes outlined in the Congressional Review Act. Specifically, absent a showing of “good cause,” this final rule (which is a “major rule” under the CRA, see infra) will become effective the later of the date occurring 60 days after the date on which Congress receives the report, or the date the rule is published in the Federal Register. For reasons discussed below, VA does not believe acceleration of the effective date is necessary.

VA expressed interest in determining whether the partial claim payment should include amounts corresponding to what will be due for such items, where the bills were not due and payable during the COVID-19 forbearance. VA also sought input regarding how best to calculate and disburse such amounts, as well as how to conduct oversight to ensure the monies were directed to the appropriate tax authority or insurance provider. In other words, while VA has not prescribed a waterfall of home retention options, in cases where the servicer determines that the partial claim option is an optimal method, the servicer should pursue it, rather than another option. This will help shield the veteran from delaying the veteran's financial recovery and help prevent the expensive and labor-intensive burdens that could be posed by an unnecessary series of home retention strategies. Comments and questions submitted by veterans, lenders, servicers, consumer groups, and trade associations were generally supportive of VA's initiative.

E. § 36.4804 Partial Claim Payment as a Home Retention Option

The OFR/GPO partnership is committed to presenting accurate and reliable regulatory information on FederalRegister.gov with the objective of establishing the XML-based Federal Register as an ACFR-sanctioned publication in the future. Until the ACFR grants it official status, the XML rendition of the daily Federal Register on FederalRegister.gov does not provide legal notice to the public or judicial notice to the courts. The President of the United States issues other types of documents, including but not limited to; memoranda, notices, determinations, letters, messages, and orders.

While VA's amendments promote a more streamlined application process, VA wants to ensure that servicers are still keeping veterans' financial interests in mind. Therefore, VA is also adopting changes to the final rule to remind servicers that the COVID-VAPCP should only be offered if the option is in the veteran's financial interest. The increase to the UPB cap does not affect the unique option that VA included in its proposed rule, which would allow for a veteran to make an optional payment or for a servicer to waive amounts that would otherwise prevent a veteran from participating. Even with VA adopting a higher UPB cap in the final rule, VA is maintaining this feature of the program, as it could help more veterans be able to receive the assistance, at no additional cost to the program. As for the requirement that veterans certify their occupancy, VA notes that, much like FHA's COVID-19 Standalone Partial Claim program for FHA borrowers, one purpose of VA's COVID-VAPCP is to ensure that veterans remain safely housed during the pandemic.

How to Get a VA Funding Fee Refund

This can happen if you're a Veteran and your exempt status can't be verified before your loan closes, you must pay the funding fee as if you were not exempt. This may include situations where your disability claim is still in pending status at the time of closing. Veterans with non-VA guaranteed home loans now have new options for refinancing to a VA-guaranteed home loan. These new options are available as a result of the Veterans’ Benefits Improvement Act of 2008.

The Department of Veterans Affairs refunded more than $400 million in erroneous home loan fees to veterans after an audit prompted a review earlier this year, the agency announced Tuesday. Learn how VA-backed and VA direct home loans work—and find out which loan program might be right for you. Neither an initial COVID-19 forbearance nor an additional period of COVID-19 forbearance can extend past the end of the nationally declared emergency. In terms of the mortgage process, it's the lender's responsibility to verify the borrower's funding fee exemption status. Your Certificate of Eligibility typically denotes whether you're exempt from paying the funding fee. Deed-in-Lieu of Foreclosure – The borrower voluntarily agrees to deed the property to the servicer instead of going through a lengthy foreclosure process.

Rather, VA has included revisions to clarify the different forms of restrictions on participation in FHA programs encompassed by this section. Changes in this section replace certain references to the CARES Act with COVID-19. These changes align the scope of the COVID-VAPCP with the coordinated federal response to veterans' prolonged financial hardship, as discussed in section III.A. VA also agrees with commenters that the September 9, 2021 sunset date should be extended, given the potential for COVID-19 forbearances extending beyond that date. VA is adjusting the sunset date in the final rule to align with the expectation that no veteran will be in a COVID-19 forbearance after June 30, 2022. Review the VA funding fee rate charts below to determine the amount you’ll have to pay.

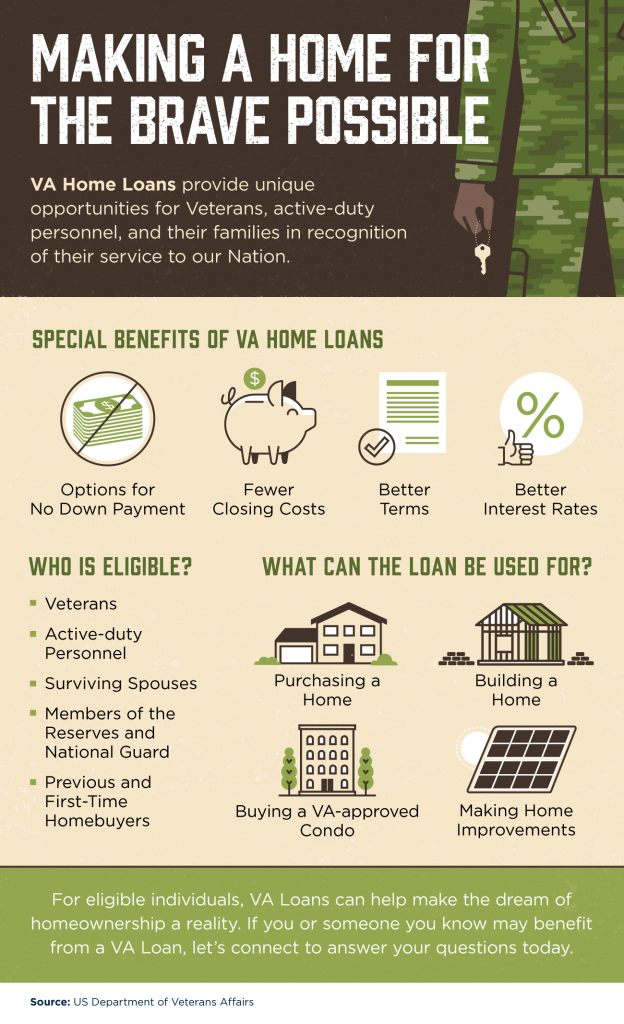

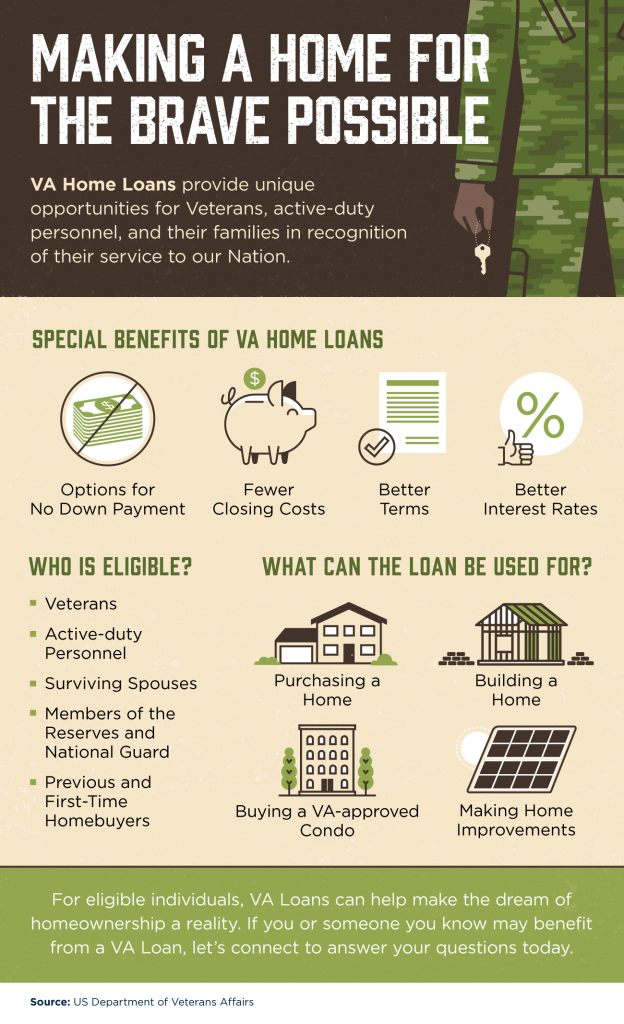

Veterans obtain VA-guaranteed loans through the usual lending institutions, including banks, credit unions, and mortgage brokers. VA-guaranteed loans can have either a fixed interest rate or an adjustable rate, where the interest rate may adjust up to one percent annually and up to five percent over the life of the loan. Interest rates are negotiable between the lender and borrower on all loan types. A funding fee must be paid to VA unless the Veteran is exempt from such a fee. Closing costs such as VA appraisal, credit report, loan processing fee, title search, title insurance, recording fees, transfer taxes, survey charges, or hazard insurance may not be included for purchase home loans. It is important to note that VA does not impose a maximum loan amount that a Veteran may borrow to purchase a home; instead, the law directs the maximum amount that VA may guarantee on a home loan.

In other words, if you use the VA loan a second or third time and don’t put any money down, you’ll pay a higher funding fee rate. For example, say you plan on purchasing a $250,000 home with no money down. If this is the first time using the VA loan, you’ll pay a funding fee of $5,750 ($250,000 x 2.3%). But, if using the VA loan a second time for this same $250,000 purchase, you’ll pay a funding fee of $9,000 ($250,000 x 3.6%). Instead, it guarantees a portion of every loan issued by VA-approved lenders (e.g. banks, credit unions, and mortgage companies).

All Veterans, except those who are specified by law as exempt, are charged a VA funding fee . Additionally, unmarried surviving spouses in receipt of Dependency and Indemnity Compensation may be exempt from the funding fee. Generally, all Veterans using the VA Home Loan Guaranty benefit must pay a funding fee. This reduces the loan's cost to taxpayers considering that a VA loan requires no down payment and has no monthly mortgage insurance.

Main pillars of the VA home loan benefit

The proposed rule further noted that VA's existing home retention, loss-mitigation, alternatives to foreclosure, and other servicing regulations and policies remain in effect. Thus, to avoid confusion, VA is adding a new subpart F to part 36 of the Code of Federal Regulations to contain the regulations that govern this temporary program. Similarly, three commenters pointed out that FHA, USDA, and the GSEs all have more streamlined documentation requirements that simplify access for borrowers and ensure relief is delivered timely.

No comments:

Post a Comment